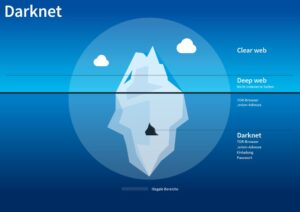

Judging from the activity on the shop, BidenCash appears to be thriving in 2023, providing an active data and money exchange platform in a market that has experienced a decline in recent years. This time, the leaked data contains card numbers, expiration dates, and three-digit security codes (CVVs). The expiration for most cards reviewed by BleepingComputer ranges from 2025 to 2029, but we also spotted a few expired entries from 2023. Contrary to popular belief, most carding platforms no longer hide in the dark web (i.e. the Tor network).

Darkweb Market BidenCash Gives Away 12 Million Credit Cards For Free

The threat actor’s marketing strategy involves leaking a large number of credit cards to attract potential clients from hacking and cybercrime forums. This move is likely to increase the platform’s popularity and draw in new customers. Stolen credit cards are often used to make purchases at specific sites that don’t have protections against fraud. Dark web credit cards are often sold on online marketplaces, which can be accessed through specialized browsers like Tor.

Secure Your Personal Information

The globalnature of NFC payments and the anonymity provided by money mules andencrypted communication channels make these fraud operationschallenging to track and shut down. Suchwallets leverage NFC technology to facilitate secure and convenientcontactless payments, enabling consumers to make payments by simplytapping their NFC-enabled smartphones against compatible paymentterminals. When a user initiates a payment, a wallet generates aunique encrypted payment code transmitted to the NFC-compatibleterminal.

We Talked To A Teenaged Credit Card Scammer About Dark Web Fraud

- Passphrases, distributed denial-of-service (DDoS) protection pages, and multifactor authentication are all quite standard on many darknet marketplaces.

- If you can, use an online wallet like Apple Pay or Google Pay, says Pascal Busnel, a director with ACA Group, a provider of risk, compliance and cyber solutions.

- Designed to emulate NFC cardsthrough HCE, the application enables unauthorized access tocontactless systems, including payment terminals and credit cardinfrastructure.

- The best course of action is to focus on damage control, such as cancelling the compromised card and monitoring your accounts for any unusual activity.

Credit card skimmers are designed to look exactly like card readers so that people aren’t suspicious of them. When a victim falls for a card skimmer and inserts or swipes their card, their card gets scanned and the card information is sent to the threat actor through Bluetooth. The victim’s transaction still goes through normally, so they won’t even know their card has been skimmed until it’s too late. Depending on the type of account a cybercriminal compromises, they can gain access to many types of personal information, including your credit card information. Not only is there a way for hackers to discover payment card numbers without breaking into a database, there’s also a booming underground black market for them. The shop offers stolen card data from around the world for as low as $0.15 per item and uses verification and automated checks to check the validity of the cards people put up for sale on the platform.

In addition to just selling credit card details, some threat actors offer a “complete package” often referred to as “Fullz”. Fullz includes full personal details as well as financial details such as bank account details or social security numbers, which can be used for a full account takeover or identity theft. Payment information is stolen in a variety of ways before it ends up on the dark web. Many payment card numbers are stolen via data breaches; threat actors compromise payment sites, allowing them to stealth credit card numbers.

Unmasking The Underground: Navigating The Threat Of Dark Web Credit Card Marketplaces

Resecurity has identified several cybercriminal groups targeting financial institutions and their customers in the UAE and other countries of the GCC . Based on the analysis of the posts, Chinese cybercriminals target the US, Australia, Canada, Japan, the UK, Malaysia, and Taiwan, along with African countries, as their main priority for conducting fraud. MultipleChinese-speaking cybercriminal channels dedicated to carding havebeen identified on Telegram, with some having over 5,946 activemembers. Taking these proactive steps and tapping into available resources can empower you to make informed financial decisions and act swiftly should a data breach occur. In the ever-changing landscape of the digital world, community support can be a powerful ally. Incorporating these simple yet effective habits into your daily routine can make all the difference, keeping you several steps ahead of cybercriminals lurking in the digital depths.

However, thetechnology behind NFC (Near Field Communication) has been aroundsince the early 2000s, with the first NFC-enabled phone launched byNokia in 2006. As NFCtechnology became more widespread, reports of fraud and cardingincidents started to emerge, mainly as mobile payment systems likeGoogle Wallet and Apple Pay were introduced. Each time you secure your online account, update your passwords, or check your financial statements, you’re participating in a silent revolution—a movement where consumers take charge of their own financial security.

Indicators Of Compromise In Threat Intelligence

Although there’s a variety of goods to be purchased on the dark web, one of the most sold resources by volume on the dark web, if not the most sold commodity, is stolen credit cards. Just last week, the largest carding site operator announced they would be retiring, after allegedly selling 358$ millions worth of stolen cards. In2020, students at the Technical University of Darmstadt, Germany,developed NFCgate to capture, analyze, or alter NFC traffic. The “Ghost Tap” technique enablescybercriminals to cash out money from stolen credit cards linked tomobile payment services such as Google Pay or Apple Pay by relayingNFC traffic via NFC-enabled POS terminals. In this case, bad actors”tap” their mobile devices with stolen, compromised data tomake fraudulent transactions.

Detecting Fraudulent Activity On Your Accounts

APDU (Application Protocol Data Unit) commands are the standardized communication units used between a smart card reader and a smart card. They are essential for executing operations on smart cards, such as reading data, writing data, or performing cryptographic functions. They all use HostCard Emulation (HCE) tomimic a physical ISO14443 NFC smart card byregistering a service that extends HostApduService. David Hollingworth has been writing about technology for over 20 years, and has worked for a range of print and online titles in his career. He is enjoying getting to grips with cyber security, especially when it lets him talk about Lego. If you have the need to own 500 million compromised Facebook accounts, that will set you back US$19.99, which honestly may well be over-egging the deal.

To avoid such losses, it is crucial to regularly monitor credit card transactions, report any unauthorized charges promptly, and take proactive steps to protect personal information. It is crucial to approach the Dark Web with caution and fully understand the risks involved. It is illegal and unethical to engage in activities that exploit stolen credit card information. Protecting personal information and ensuring online security should always be a top priority. In the ever-evolving landscape of cyber threats, businesses face not only financial losses but also significant reputational damage when targeted by fraud actors on the dark web.

Hundreds of millions of payment card details have been stolen from online retailers, banks and payment companies before being sold on online marketplaces such as UniCC. Using PureVPN can create a private and secure connection to the internet and reduce the risk of getting your stolen set of dark web credit cards. More than being a place for the secure transmission of information and communication, the dark web has become the breeding ground for illegal activities.

Avoid Having Your Credit Card Info Published On The Dark Web

Financial institutions shoulder increased operational costs tied to investigating fraudulent activities and failed authentication attempts. Customers who lose their card data to fraud may turn to a different card while waiting for a replacement card, threatening the top-card effect of passing all spending across one preferred card. In some markets, like the US market, those interchange fee revenues can approach 3% of all transactions. Simultaneously, customers face the risks of identity theft, damaged credit scores, and the emotional toll of financial fraud. Legitimate users of the dark web include activists, or people who live under oppressive regimes, but they only account for a small percentage of the dark web. The sale of payment card information is big business; in 2022, the average price of stolen credit card data averaged between $17 and $120, depending upon the account’s balance.

Kim Komando hosts a weekly call-in show where she provides advice about technology gadgets, websites, smartphone apps and internet security. Credit card details with balances up to $5,000 go for $110, and online banking logins with $2,000 or more go for $60. Actual or formally correct ID card numbers are among the most expensive goods on the dark web.

Unlike online fraud, this type of theft is harder to detect because the transaction appears as a regular swipe. These details often land there after data breaches, phishing attacks, or malware infections that steal information from unsuspecting users. If your credit card number appears on the dark web, it means someone has likely leaked or stolen it—and now it could be traded, sold, or used without you even knowing about it. Imagine entering a dimly lit room, filled with whispers and secrets, where the boundaries of legality blur into obscurity.

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Resecurityidentified multiple Chinese cybercriminal groups targeting Google andApple Wallet customers. Their modus operandi centers on the abuse ofNFC payments and the misuse of technology to conduct fraud. Ouranalysts from the HUNTER unit identified a group on Telegram offeringthe Z-NFC tool for sale to facilitate fraudulent transactions. Another tool, called King NFC, was previously marketed on the Dark Web as an alternative.