On May 18, 2021, China banned financial institutions and payment companies from providing services related to cryptocurrency transactions. This has led to a sharp drop in the price of the largest proof of work cryptocurrencies. For example, Bitcoin is down 31%, Ethereum is down 44%, Binance Coin is down 32%, and Dogecoin is down 30%. Proof of work mining was the next target, with regulators in popular mining regions citing the use of electricity generated from highly polluting sources like coal to create Bitcoin and Ethereum.

Silk Road (marketplace)

Although business boomed, Silk Road’s foundation began to crack under the weight of its success. Libertarian idealist Ross Ulbricht grew up in Texas and received a degree in physics from the University of Texas at Dallas before earning a master’s degree in materials science and engineering. Not long after graduating, he began developing an idea for an untraceable marketplace where individuals could transact whatever they wished—outside of the usual rules of such online platforms (and the government). We calculate our valuations based on the total circulating supply of an asset multiplied by the currency reference price. All of that means Telegram’s takedowns are by no means the end of the crypto-scam industry, says Robinson. They may, however, represent a serious setback for the markets that cash out its profits and launder its money.

Economic Distortion

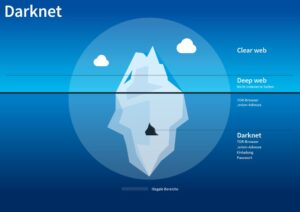

Analogously, we identify and characterise ‘multisellers’ (i.e., multihomers that are sellers) and ‘multibuyers’ (i.e., multihomers that are buyers). Furthermore, we analyse the seller-to-seller (S2S) network, i.e., the network composed only of transactions among sellers, which can be regarded as a supply chain network of illicit goods and services. We highlight that these networks exhibit different resilience regimes in the presence of external shocks, the ecosystem’s resilience being mostly guaranteed by the network of buyers rather than sellers. Cryptocurrencies have become integral to the dark web economy, enabling illicit transactions and fueling cybercrime activities.

Nevertheless, such issues as right-wing parties in government, state sovereignty and resource insufficiency prevent a high-level of cooperation among countries. Consequently, such diplomatic action and multilateral treaties are needed to overcome these difficulties and to promote good neighborliness and mutual understanding amongst the countries involved. The international community’s collective strength is solidified by the unity that borders offer.

Symbiotic Relationship Between Legal And Black Markets

The Dark Web and cryptocurrencies that provide anonymity have made it stronger to combat illicit trade and created an immense incentive for law enforcement agencies and policymakers globally. Crypto is also facilitating illicit activity in black markets and drug supply chains. For example, crypto plays a growing role in the fentanyl crisis that is devastating communities across the U.S. Cryptocurrencies make it easier for traffickers to evade money laundering laws. In Arizona and California, law enforcement seized over five tons of fentanyl worth more than $100 million by tracing crypto transactions.

Thai, Cambodian Militaries Chart Path Forward After Deadly Border Fight

This will be the case, as long as there are gaps in regulations and people’s needs, and the illicit economy will survive finding new technologies and reacting to new social and political views and attitudes. This process not only facilitates the reduction of token supply across various blockchain networks but also enhances the utility and scarcity of the remaining tokens. The BLACKHOLE PROTOCOL’s expansion across multiple blockchain platforms, including Ethereum, Polkadot, BSC, Heco, and SOL, underscores its adaptability and the broad interest in deflationary mechanisms within the cryptocurrency community.

- In response, governments are enhancing blockchain surveillance and enforcing stricter regulations to combat crypto-enabled cybercrime.

- Black markets are also known as illegal markets, shadow markets, or underground markets.

- Experts estimate that sex trafficking and forced labor generate as much as $150 billion a year in profits.

- The cross-border nature of cryptocurrencies, the potential for regulatory fragmentation due to inconsistent legislation, and under-resourced state agencies all limit what states can do on their own.

- Despite its name, the marketplace operates primarily in English and serves a global audience.

So “digital wallets” were developed as places to keep this currency, and digital wallets can be hacked, or even inadvertently erased. Many third-party companies that promised to protect and store users’ bitcoins simply disappeared, and with no oversight from any government, there’s no recourse to get that digital currency back. Black markets facilitate the exchange of a wide array of goods and services that are either illegal or transacted to avoid regulation. Categories include illicit drugs, such as cocaine, heroin, and methamphetamine. Counterfeit goods, from luxury items to pharmaceuticals, are also commonly sold.

Organized Crime

The underground economy, which covers everything from illegal drugs and weapons to fake goods and human trafficking, spreads across continents and touches all strata of society. Although law enforcement agencies intercept a fraction of drug traffickers and incarcerate thousands of wholesale and retail sellers and users,23 the demand for such drugs and profit margins encourage new distributors to enter the market. Drug legalization activists draw parallels between the illegal drug trade and the Prohibition of alcohol in the United States in the 1920s. A balanced regulatory approach is essential to ensure security without stifling innovation. Global cooperation, adaptive legal frameworks, and cross-border enforcement are crucial in addressing emerging threats. By harmonizing regulation, security, and technological advancements, the cryptocurrency ecosystem can become more transparent, secure, and sustainable, fostering trust and long-term growth in digital financial markets.

We And Our Partners Process Data To Provide:

That’s compared to 31% of survey respondents who said they began investing through 401k plans. Those entering the cryptocurrency market tended to be younger and open to more volatile investments, which is typical among other kinds of investments. The largest component of the S2S network of U2U transactions between sellers for each year with the respective number of nodes (N). The nodes are sellers that are active in that year, and an edge is placed between two sellers if at least one transaction occurs between them during that year. The network is mostly populated by U2U-only sellers, followed by market-only sellers. After a major external shock in 2017, the S2S network shrinks but, unlike the multiseller network, recovers, and grows again (though slower than the multibuyer network).

Why People Seek The Black Market

While some harms from crypto are already being felt, others are looming on the horizon. Many of the most serious risks may be mid- to long-term in nature, but history shows how quickly unchecked financial risks can spiral into crisis. From the 2008 financial crisis to the 2023 collapse of Silicon Valley Bank, we have seen how when things go wrong, it is not industry executives who pay the price.

The period of dominance by Silk Road is unique, because the ecosystem structure is effectively composed of and dominated by a single market, expressed by a market share equal to one, as shown in Fig. After the shutdown of Silk Road, in the last quarter of 2013, the ecosystem evolves to a structure where several markets coexist. This structural change is reflected in the median net income of sellers and buyers, as shown in Fig. While the curves for the seller and buyer median net income were negatively correlated before Silk Road’s shutdown, after that moment they became positively correlated. Specifically, sellers show a trend of increase and buyers a trend of decrease in their median net income before the shutdown. When the FBI confiscated Ulbricht’s computer, they seized his 144,000 bitcoin.

Ready To Explore Web Data At Scale?

Authorities are strengthening forensic blockchain analysis and regulatory measures to counter crypto-enabled illicit financing while balancing financial innovation. Cryptocurrency money laundering methods have dominated the development of blockchain technology, using privacy tools and decentralized infrastructure to conceal illicit financial transactions. The methods take advantage of the pseudonymous nature of cryptocurrencies and evolve constantly to remain one step ahead of regulatory monitoring and blockchain analytics. Bitcoins have earned a bit of a dark reputation due to how the system allows buyers and sellers to remain anonymous.