The term dark web cash app hack has become a buzzword in recent years, representing a growing concern for users of financial applications. The dark web is notorious for illicit activities, including hacking and fraud, which can threaten the security of financial transactions. This filing details the security breach that occurred when a former Cash App employee illegally accessed and downloaded reports related to Cash App Investing. The reports included full names and brokerage account numbers, but fortunately, no other personally identifiable information was stolen. Identity thieves target people’s personal information, online accounts, Social Security numbers, and a bunch of other types of personally identifiable information. For Cash App users, phishing is the No. 1 risk, which could lead to the hacking of their Cash App account and loss of funds.

Regularly Update And Secure Your Devices

They’ll often start small — promising to turn $200 into $1,000 — and offer a “money-back guarantee” if you’re not happy. Immediately change your password and contact Cash App support to report the incident. This article explores the complexities surrounding this issue, focusing on the implications, risks, and preventative measures one can take. Martinelli said Zhong appeared resistant to her theories, especially when they began to focus on his circle of friends. Martinelli eventually settled on one suspect in particular who she believed had stolen 150 bitcoins from Jimmy. Darknet markets — also known as cryptomarkets — provide a largely anonymous platform for trading in a range of illicit goods and services.

Additionally, using reliable antivirus software can help detect and prevent malware infections. By adopting a responsible and ethical approach to your finances, you can work towards a more secure and prosperous future. The Cash App Glitch can take various forms, including bonus offers, transaction manipulations, or referral loopholes.

- Identity security refers to the tools and processes intended to secure identities within an organization.

- According to a recent study, Cash App was the third most targeted financial app in 2020, with over 1,000 reported cases of hacking and fraud.

- The threat of a dark web cash app hack serves as a cautionary tale for users of mobile payment platforms.

- Cash App is a popular mobile payment service that allows users to send, receive, and manage their finances conveniently.

- The Cash App data breach was caused by a former employee who accessed customer financial reports as an act of revenge against the company after their employment was terminated.

How Hacks Occur

They may impersonate customer support agents or acquaintances, tricking users into revealing their account details or executing fraudulent transactions. Create strong, unique passwords for your cash app accounts, combining uppercase and lowercase letters, numbers, and special characters. Avoid reusing passwords across different platforms to minimize the potential impact of a data breach.

What To Do If Your Cash App Account Is Hacked

In today’s world, cyber threats are becoming more sophisticated, and even the most robust security measures cannot guarantee total protection. A directory service is a database containing information about users, devices, and resources. As we continue to combat the increase in cybersecurity threats, it’s essential that businesses have a comprehensive plan in place to protect their assets…. In today’s ever-evolving threat landscape, businesses must remain vigilant in defending their networks against potential attacks. A June 2024 letter posted on the state of Massachusetts website revealed that Citibank experienced a data breach last year.

The application process includes asking for the online banking credentials and/or account number to verify account balances (red flag). The company may implement biometric scanning along with other security measures to safeguard sensitive information about customers and internal information. However, in the meantime, the best course of action for businesses and everyday people is to enhance their digital protections with the industry’s latest tech safeguards. The dark web cash app hack has become a troubling topic as digital transactions become more mainstream.

Are There Any Cash App Referral Hacks?

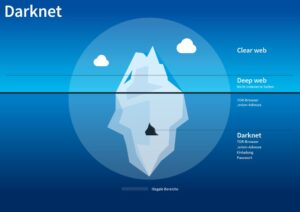

Manipulating a financial app’s system for personal gain may violate terms of service or even local laws. Engaging in fraudulent activities can lead to severe legal penalties, including fines and imprisonment. Additionally, if you unknowingly gain unauthorized access to someone else’s funds through the glitch, you could face criminal charges. The dark web is a hidden part of the internet that is not indexed by traditional search engines. It is notorious for being a hub of illicit activities, including the buying and selling of stolen data, hacking tools, and even personal information.

Recovery Steps If Hacked

Hackers may also exploit vulnerabilities in the Cash App software to gain unauthorized access to user accounts. These vulnerabilities may be caused by outdated software, unpatched bugs, or other security flaws. Hackers can use these vulnerabilities to gain access to a user’s account without their knowledge or consent. It is essential to stay informed about potential risks and take necessary precautions to protect your account and personal information.

How To Transfer Money From Cash App To Bank Account?

This information is then sold on the dark web to other cybercriminals who use it for fraudulent activities, such as identity theft and financial fraud. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Aura’s all-in-one digital security solution proactively protects you from Cash App scammers (and worse).

This poses a significant threat to the security of cash app users, as their personal and financial information could be compromised by cybercriminals. It is important for individuals to be vigilant and take steps to protect their accounts from such attacks. On the dark web, a thriving market exists for stolen Cash App accounts and user data. Hackers sell account credentials, credit card information, and even tutorials on how to carry out successful cash app hacks. These illegal activities not only result in financial losses for individuals but also erode trust in mobile payment platforms. But scammers have also started to send unsolicited Cash App debit cards through the mail with instructions to download the app and scan a QR code to set it up.

OAuth (OAuth 2.0 since 2013) is an authentication standard that allows a resource owner logged-in to one system to delegate limited access to protected… NIST compliance broadly means adhering to the NIST security standards and best practices set forth by the government agency for the protection of data… A man-in-the-middle (MITM) attack is a cyber attack in which a threat actor puts themselves in the middle of two parties, typically a user and an… Log analysis is the practice of examining event logs in order to investigate bugs, security risks, or other issues. Lateral movement is when an attacker gains initial access to one part of a network and then attempts to move deeper into the rest of the network —… Identity governance and administration (IGA), also called identity security, is a set of policies that allow firms to mitigate cyber risk and comply with…

Once they have access to an account, they can transfer funds, make purchases, and even sell the account information on the dark web. However, engaging with a hacker in any way will make it more likely that you get hacked. They’ll find a way to fool you and make you click a link, which is what leads to you getting hacked. Only a small percentage of victims need to click the link in the text for the campaign to be successful. The victims may unwittingly download malware or be directed to a malicious site where they enter personal information. After earning enough trust, the scammer fabricates an emergency and asks their target for help.

With the right knowledge, tools, and mindset, we can avoid falling victim to Cash App scams. There is another safety-related aspect, however, that only Cash App has control over, and that’s the collection, processing, and sharing of our personal data. Here are just a few of the scams and MOs fraudsters use to lure Cash App users into sending them money. Standard methods include getting targets to download a screen-sharing app or outright asking for the information. Once they have the account details, they’ll use the account’s existing balance or credit to make purchases for themselves. Hackers are breaking into unsuspecting victims’ Cash App accounts, a massively popular payment app, and stealing hundreds of dollars, according to victims Motherboard spoke to.

According to a survey by the Wall Street Journal, almost 70% of companies are concerned about the risk of insider threats.

” Liz Shelby, who said their son was a victim of the hacking, told Motherboard in an online chat. The best way to avoid hacks via texts and calls is not to answer numbers you don’t recognize. You might be the victim of a call-back scam, and calling back may charge you at an international rate, with the hacker getting some or all of it. And watch out for social engineering tactics that fraudsters use to get you to click a malicious link. Over the years, the value of the bitcoin stolen by the Silk Road hacker had soared to more than $3 billion, according to court documents. Investigators could track the location of the currency on the blockchain, which is a public ledger of all transactions.